Ad Quickly Compare some of the Sharpest Variable Fixed Rates on the market. But if the bank is owned by government it is permissible to take loan with interest provided that taking loan should be with the intention of securing a property whose owner is unknown.

Compare Fees Repayments Rates From Top Lenders Now Save.

Is it permissible to take home loan in islam. If you give a loan without the condition of interest then it is known as al-qarzu 1-hasan a good loan. If a Muslim intends to get a loan from such banks it is necessary that he should do so with the intention that it is a transaction without return even if he knows that he will end up paying the capital as well as the interest. Ad Calculate Your Savings Compare Our Rates.

Is it permissible to take loan in islam. If the loan is interest-bearing then it is not permissible. Take Advantage Of Our Super-Low Rates For Home Buyers.

There is no question that based on the Quran riba on loan is Haram. HECS - Higher Education Contribution Scheme. Ibn Qudaamah may Allah have mercy on him said.

The necessity dharura you have referred to is when one is in a situation of dire need and is exposed to perishing or sleeping on the streets. Unless its necessary to live in a society like the west where the entire economy is based off interest. I know that riba is haram in Islam.

Every loan in which it is stipulated that something extra must be paid back is haraam with no difference of scholarly opinion. The interest on the loan will be paid by him and not myself. They aim to follow the Islamic rules.

However I need to know if it would actually be haram for me to take bank loan for helping my friend who is in a pathetic condition if the monthly loan and everything ie. Always keep your journey towards halal. Pre-Qualify in 2 Minutes.

Thankfully there are Sharia-compliant mortgages and products available in Australia. HELP - Higher Education Loan Program Answer Summary. Apply Online in Only 5 Easy Steps.

It is permissible to execute a verbal contract for a loan and as such by the action that a sum is given to someone with the intention of a loan and the other side takes it with this same intention. Visit Ijarah Finance to know more. Apply Online in Only 5 Easy Steps.

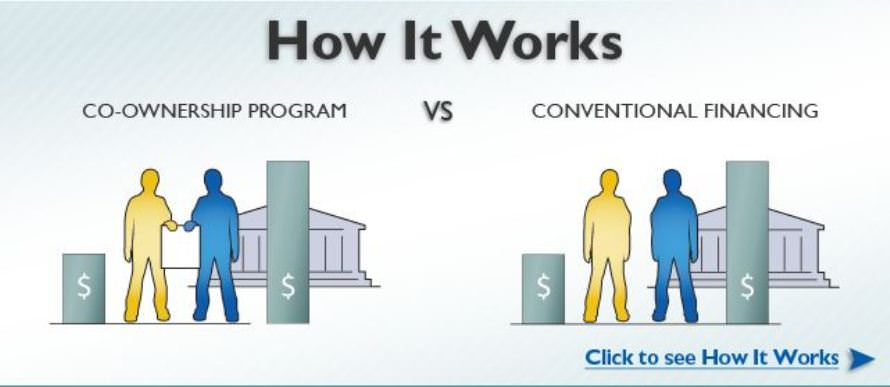

Mortgage is permissible in Islamic law because it is a form of murabaha. In Islamic banking charging interest is forbidden under Sharia law so most home loans wont be appropriate for Muslims. If one thinks that it is Haram to pay interest then the burden is on him to bring evidences.

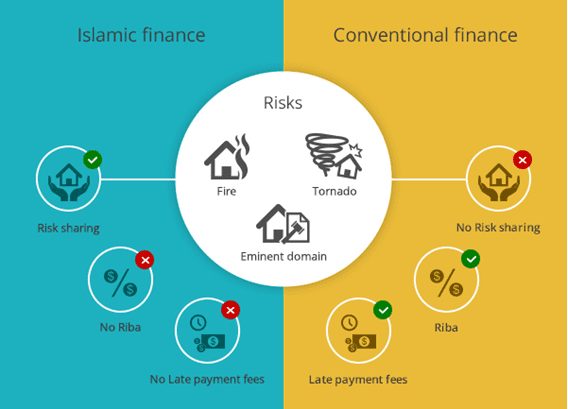

And he should not do so with the intention of getting the loan with the condition of paying interest. Islamic Bank Home Loan works on 3 core principles that make it very different from normal loans. Simplify Your Home Loan With Low Fees At Competitive Rates Flexible Ways To Repay.

The needy were allowed to take loan. Having taken the loan he considers it as a loan given to him on behalf of a Hakim Shara Islamic judge. ALLAH will show His mercy in your favor.

Answer 1 of 7. Even though deferment is not considered real currency in murabaha there is an increase in price for deferment. You should consider living at home if you can too.

But if youre otherwise going to take out a student loan taqwa dictates that you dont eat out every night and rent the best room in halls. It would not be permissible to take out a loan on interest for the purchase of a house unless one is in a situation of dire and extreme need. Basically charging any kind of interest or earning from it is not allowed in Islam thus Islamic bank loans are a great way for Muslims to get loans for them.

They give you an interest-free loan. An interest free loan and is considered a very good deed in Islam. So if we take a goodly loan from a bank to buy the house then there is nothing wrong with it.

I know Ive been there myself. So it is not permissible to take out a riba-based loan in order to buy a house. The borrower is liable to return the exact amount.

How does Islamic finance work. Both situations are proper. Pre-Qualify in 2 Minutes.

The general definition of a permissible loan according to Islamic Jurisprudence is the voluntary act of compassion. Many ahadith say that the reward for giving charity is multiplied ten times whereas the reward for giving an interest free loan is multiplied eighteen times. You have to return the actual amount of the loan neither less nor more.

Interest is forbidden in Quraan because during those days money lenders exploited the needy in one or the other way. If the loan does not accrue riba usury interest then it is permissible. Work whilst at university.

It is a sale in which it is permissible to stipulate an increase in price in exchange for deferring payment. The Quran treats the payer of usury as the victim. Government Student Loans Question Is it permissible for a Muslim to take a government student loan like HECS-HELP in Australia for example.

Ad Macquarie Is the Smart Choice For All Of Your Banking and Financial Needs. This is by a lender lending a well-defined and legally owned amount of money to a person in dire need for the receiver borrower to benefit from and fulfill his needs. If you take the money from a Non Muslim bank and use it in lawful way then it is allowed.

As such the prohibition of money lending with interest was imposed. There is no such evidence in the Quran and any other evidences need to be understood based on the directive of the Quran. If you take the money from a Muslim bank then you must have with them an agreement within the frame of Islamic rules of business.

Ad Calculate Your Savings Compare Our Rates. Take Advantage Of Our Super-Low Rates For Home Buyers. Taqwa dictates that you cycle everywhere and take advantage of the 16-25 railcard.

Islam And Economics Is My Conventional Mortgage Riba A Public Challenge

Islamic Finance Is Not More Expensive Than Conventional Home Loans

Riba And The Permissible Loan An Islamic Perspective Quran For Kids

Response To Muslimmatters Post On Halal Mortgages Muslimmatters Org

My Halal Student Debt How Muslims Navigate University Loans Metro News

Tidak ada komentar:

Posting Komentar