All mortgages are interest based including the so called Islamic home purchase plans. Let me elaborate on this.

Is Buying A House With A Mortgage Haram Or Halal Quora

I dont have kids but even were I to have them I dont think that would change my view on whether a home is a necessity or not in our current context.

Is it haram to have a mortgage. A house that isnt maintained will rapidly lose value and might end up being worth less than the loan that is secured to it which would be. And I keep asking myself how do I want to get that. Mortgage is essentially used to mean immovable financing system.

Mortgage is haram as it charges interest although as you have sene above the way it is perceived can influence peoples views on if it is Haram or Halal. Yes you can do Hajj even if you have mortgage. But the property is mortgaged to the financing company for the customers debt to the company.

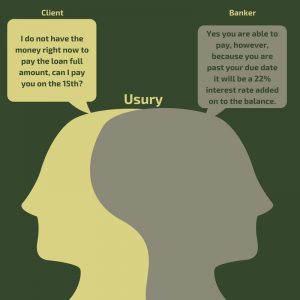

But paying the rent I have to pay in this manner for the rest of my life and never be the owner a house. This is also referred to as usury and the related Islamic concept is riba. For loans if the lender is after my life to payoff my loan then if I have money I must pay the lender and not use that for Hajj.

Is it haram to work in Financial Services. If I pay as mortgage I will be the owner of that house after several years. Key thing is I also hold Islamic mortgages are acceptable so while I see having kids means you want a house more I would just got for an Islamic mortgage as that is an option for me.

In UK I am paying the amount of money as rent which I can pay as mortgage. May Allah bless you. Paying interest is viewed as a sin in Islam and Allah says.

This loan involves interest which the client has to pay to the bank. This mortgage will be for an investment property in London UK rather than as a first home. Who else is going to fix it.

If you are dealing with riba then it is a big sin. I work as a mortgage broker in canada. But a sin does not prevent a Muslim from going for Hajj.

Some argue that both the work you do should be halal inside such a shop and the salary you get should also be from the halal part of the income is this true and if so how could one ever be sure that one gets their salary from the halal income. The reason why people consider a mortgage Haram impermissible is because they believe that the interest paid to the lending institutions or banks constitute Riba Usury. Even if youre continuing to live in the house and are planning to rent out a room your lender will still want to know.

It is probably a condition of the mortgage that you keep the house in good repair. Not rent fix flip etc. I would be most grateful for a prompt response as I have a property I would like to purchase and dont want to lose it if.

May Allah bless you. Is it Haram to buy a property with a conventional loan and then rent the property and after few years sell it for a profit. Praise be to Allah.

It means that i arrange financing for people who want to buy a house but do not have money and i arrange loan for them from bank and i get commission from the bank. I know taking loan and mortgage in haram in Islam. Is Haram or Halal to have a conventional mortgage selfIslamicFinance submitted 4 months ago by hondacivicb16b.

Is taking a mortgage allowed in Islam. Not rent fix flip etc. Answer 1 of 5.

Is it allowed to work in a store that have some haram goods yet one doesnt deal with those haram goods but with the halal goods the store got. A mortgage is a haraam riba-based transaction that is based on a loan with interest in which the owner of the money takes as collateral the property for the purchase of which the borrower is taking out the loan until the debt has been paid off along with the interest riba. Is this kind of job allowed in islam or should i change the job and is my earnings halal.

Some will have no restriction whatsoever allowing you to take out as many mortgages as you like so long as you can come up with the deposit and prove that youre rental income will cover the costs. Exactly how much rental income is required for the mortgage to be allowed will depend on the lender. Is it religiously allowed to buy a house with the mortgage system.

What is an Islamic mortgage There are a variety of different types of home loans out there some pretty conventional and some a little less so. Ive heard the only time you can get a mortgage is for the house you live in. Is it Haram to buy a property with a conventional loan and then rent the property and after few years sell it for a profit.

In this time it is quite tough to pay. If you breach these terms you are. Traditional mortgages involve paying interest Islamic mortgages do not.

I have tried to get a mortgage from Al-rayan but their criteria seems to be for the rich they say they do 8095 FTV etc but when I present my situation they say if you can pay like 40 upfront it will be okay. Dicussion on any aspect of Islam. If youre an owner-occupier the terms of your residential mortgage will state that youre unable to rent your home to anyone without obtaining prior consent.

Earning interest riba is not allowed whether youre an individual or a bank. Those who devour interest will not stand except as stands one whom Satan has driven mad by his touch Sûrah al-Baqarah. The fundamental reason why a traditional mortgage is considered to be haram by many Muslim scholars and leaders is that involves interest.

Financing company buys an immovable property that the customer demands on behalf of the customer for cash and transfers the ownership to the customer. Is Haram or Halal to have a conventional mortgage. Posted by just now.

Is paying Riba Haram. Why is mortgage Haram. Some will want your rental to total 150 of.

Youre not allowed to lend or take money from someone under Sharia law if interest is being gained. I argue that buying a house or any property with a mortgage is Halal permissible. Answer 1 of 3.

An Islamic mortgage lets you borrow money for a home while still following Sharia law. One you may have heard about but might not be clear on is an Islamic mortgage which as the name implies is. Is Haram or Halal to have a conventional mortgage.

Ive heard the only time you can get a mortgage is for the house you live in.