Click the Online Services tab on the menu bar. Link your Aadhaar to UAN b.

Pf Withdrawal Follow These Steps To Withdraw Epf Money Online And Offline

Login to the portal Visit the EPFO e-SEWA portal log in using your UAN and password and enter the captcha code.

How to withdraw pf money after retirement. Build a complete financial plan with our Robo Advisory Tool. In case youve forgotten your password you can reset it via an OTP sent to. While it is possible to withdraw the EPF corpus before retirement it is still advised that you do not do so.

2 Log in with your UAN password and captcha. Also EPF allows premature withdrawals under certain conditions. Under EPF Act 1952 you can withdraw the full PF amount if you retire from your service after having attained the age of 58 years and you can also claim the EPS amount Employees Pension Scheme amount at the same time.

EPF is a long-term retirement savings scheme. Online Withdrawal of PF with UAN. Withdrawing PF balance only and reduced pension age 50-58.

Unemployment-A person can withdraw 75 of his or her provident fund if heshe is unemployed for more than a month. Remaining amount should be invested in debt fixed income instruments. 1 Provident fund withdrawals before five years of completion of service will attract tax deducted at source TDS at 10 per cent.

Furthermore if you are unemployed for more than two months you can withdraw the PF balance completely. PF money after Resignation. 3 TDS will be deducted at.

Step 2 Then input your UAN your password and the Captcha to sign in. According to the PF withdrawal rules you can submit a PF withdrawal application through the EPF portal. The gazetted officer must certify that the individual is unemployed for more than 2 months for himher to receive the PF money.

Online EPF withdrawal requests can be settled within 15 to 20 working days from the date of submitting the request. Submit an application to withdraw EPF online. This is because early withdrawals from the EPF are not a part of the tax-deductible income of the employees.

Provident fund PF in India is mandatory by law. After retirement you should withdraw your PF. To withdraw PF through the physical application procedure it is necessary to drop into the respective jurisdictional Employee Provident Fund Organization office and commence the withdrawal process through a due submission of a Composite Claim Form aadharnon-aadhar.

How to withdraw your PF savings with UAN. Currently the EPFO allows 75 PF withdrawal if it is carried out after just 1 month of unemployment. You can withdraw the entire EPF balance upon retirement.

Form-19 can be downloaded from the EPFI website. Physical Application Procedure. Here are the steps you need to follow.

Complete Provident Fund PF money can be withdrawn when an individual retires from employment and remains unemployed for more than 2 months. Step 1 To initiate EPF withdrawal online you first need to activate your UAN at the UAN member portal. Visit the UAN Member Portal and login using the UAN and password.

Withdrawing PF balance only and full pension After 58 1. EPF Withdrawal Procedure Online 1 Go to EPFO Member e-SEWA portal. Things to know about withdrawing your EPF post-retirement For a smoother withdrawal process make sure that all your PF accounts are merged into one so that all EPF balances get.

Over 10 years of service 4. The employee is allowed to withdraw up to 90 of the provident fund balance. You can easily withdraw your PF online through your UAN by visiting the EPFO e-SEWA portal.

The money can be withdrawn only after retirement. Even though the main purpose of the EPFO service is to provide financial security and savings for retirement you can also withdraw a certain amount of the money in your PF account if you are in need from the comfort of your home. The total PF amount comprises the contribution made by you and your employer plus accrued interest.

EPFO users can withdraw money from their PF accounts by using the UMANG app on their mobile phones. Employee Provident Fund EPF is a retirement corpus from which an employee can make withdrawals if heshe has been unemployed for more than 2 months. Provide the last four digits of your bank account when you see the Member Details.

Here are the steps. Transfer from the previous employer to the present one should be processed without fail to make the withdrawals easy. Withdrawal PF Amount After Leaving the Job.

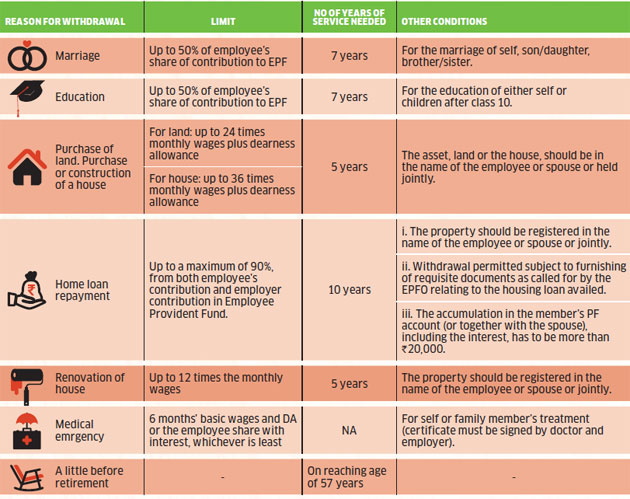

More than 700 investors and financial advisors use it. Partial withdrawal from EPF accounts is permitted in the case of an emergency such as medical emergency house purchase or construction and higher education. The online procedure for withdrawing PF is way more streamlined and hassle-free for employees.

3 On the top menu bar click on the Online Services tab and select Claim Form 31 19 and 10C option from the drop-down menu. For example if you are 60 years of age you can invest 50 in equity and 50 in debt. 4 You will be directed to a page showing member.

EPF withdrawal using Form 19. Even though the main purpose of the EPFO service is to provide financial security and savings for retirement you can also withdraw a certain amount of the money in. Make sure that the Universal Account Number UAN is linked with a registered mobile number and is active.

Withdrawing PF balance plus EPS amount for below ten years of service If service period has been less than 10 years both PF balance and the EPS amount will be paid. Members registered on the EPFO portal can use the online withdrawal facility for processing their withdrawals. For this your universal account number UAN should be activated and linked to your Aadhaar PAN or bank details.

The EPF can be withdrawn by the employee when the employee retires or is not in employment for a minimum period of 2 months or if the employee moves abroad or when the employee is dead. EPF withdrawal via UAN Online claim submission If you know your Universal Account Number UAN then you can directly apply for pf withdrawal without the need for employer attestation. The interest earned on the Provident Fund is normally tax free in the hands of the investor.

Money from the EPF account cannot be withdrawn during employment unlike a bank account. Procedure for EPF withdrawal online. Click on the Claim Form-31 19 10C on the drop-down menu.

Step 3 Once you have logged in check if your KYC details are updated in the Manage tab. 2 If the accumulated provident fund balance is less than Rs 30000 TDS would not be applicable. A person can withdraw his or her entire provident fund corpus after completing 58 years of age.

Thumb rule would be to invest 100 - Your age 10 of your Provident Fund into equity.

How To Withdraw From Provident Fund Account For Home Loan Repayment The Financial Express

After Leaving The Job You Can Withdraw Eps Money Like This Together You Get The Full Amount Of Pf

Epf Online Withdrawal Here Are Some Easy Steps To Withdraw Money From Your Account Information News

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Pf Provident Fund Withdrawal Rule How New Epf Rules Are Going To Impact You

Tidak ada komentar:

Posting Komentar