He who takes a loan with interest does not take possession of it and it is not allowed for the borrower to utilize it. Everyone can apply pending they meet the eligibility criteria.

What Is Islamic Personal Loan And How Does It Work

According to contract I have to repay 5 lac and 60 thousands.

Is personal loan allowed in islam. Ad A loan in Norway - choose the best. It varies from being Mandatory to forbidden. Trust our experienced specialists.

The kind of loan that is allowed in Islam is al-qard al-hasan a goodly loan in which you lend something to your brother so that he may benefit from the loan then he pays you back without any additional payment being stipulated and without paying less. The markup takes place of interest which is illegal in Islamic law. Eff149 65000kr 5 år kost 28730kr Tot93730kr.

The interest on the loan will be paid by him and not myself. Dear brothers and sisters in Islam the longest Aya in the Quran is known as Ayat ud Dain. Heres my take on the matter The generous Quran in the Sura Al-Baqra Verses No.

Lending people money is part of the permissible transactions in Islam. Unless its necessary to live in a society like the west where the entire economy is based off interest. Duyoon Haalah are allowed by almost all Muslim jurists on the rationale that in such loans delay is not the right of the debtor.

People want to pay off their student loan quickly for a bunch of reasons. We want know your needs and choose the best solution. Trust our experienced specialists.

Islamic personal loan concepts described above are called Murabahah and Tawarruq. When you borrow money you pay it back. Its worth noting that the bank is not allowed to charge interest on the loan.

DEBTS IN ISLAM. Commercially its better as you pay less interest. So the work around this brother did is he got a small job in McDonalds etc as he was allowed 20 hrs work etc and started paying back the loan from day one.

The Debtor of the Loan. Islamic banks around the world are reinventing the way we borrow. Whoever is unable to work and is poor is allowed to ask for help and to take zakaah and social security.

Ad A loan in Norway - choose the best. Answer 1 of 2. The Muslim whether he is rich or poor is not allowed to take a loan from the bank at 5 or 15 or more or less because that is ribaa and is a major sin.

Often an entrepreneur has to borrow money to start a business or an investor is lending money to someone to start a business. Answer 1 of 2. However there is nothing that prevents paying the loan itself along with giving an addition without it being conditional.

As such murabaha is not an interest-bearing loan qardh ribawi but is an acceptable form of credit sale under Islamic law. You believe that Islamically you need to get out of it as soon as possible as the student loan is haram. Except its not actually that simple.

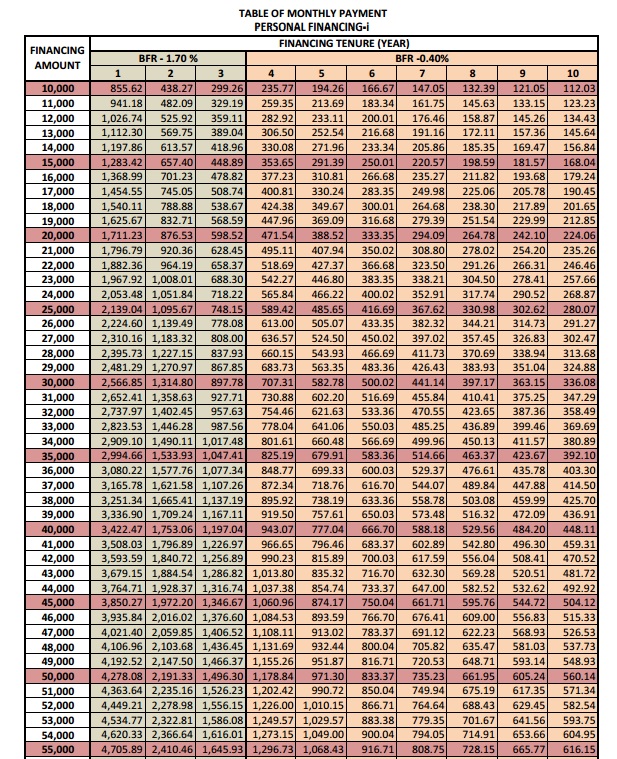

As mentioned above Islamic personal loans are not reserved for Muslims only. Personal Financing-I from Hong Leong Islamic. Rather this action is recommended and affirmed.

We want know your needs and choose the best solution. One should not buy 2-3 homes on mortgage to make profit off of that interest You should buy one home and only get the other once the first home is completely paid off. Profit rate at 75 per annum up to 135 per annum however the final profit rate will be stated in the Disbursement Notice that will be given to you upon disbursement.

Interest Islamic finance Personal finance. In fact rebate should neither be provided in the agreement nor be made a condition in the loan contract. 278 280 says.

Most places you borrow from will charge you for loaning money from them. I have come to know that 60 thousand is interest which is haram. In opposition remission of a part of a debt not yet due involves Riba.

I know that riba is haram in Islam. Saturday 15 April 2017. This is the goodly loan.

You can get Islamic financing many choices including. So essentially he will earn 500600 per month and that he ll pay that towards the payback of the loan and since he is keeping up with the pace which is equal or higher to the pace of interest - so he is able to return just the amount. Sharia Compliant Home Financing Interest Free Islamic Mortgages Halal Mortgages Ijara Canada Islamic Finance Sharia Mortgage Islamic Finance Ijara Islamic Financing Shariah Home financing sharia home bu.

Personal Loan from Bank. I have taken 5 lac bank loan from conventional bank on 36 monthly installments. Minimum amount RM5000 and Maximum RM150000.

While there are whole books written on the topic of Islamic finance and the multiple financial instruments available for this type of commercial transaction the Quran in one ayat Surah Baqarah 282 details the basic rules for borrowing and lending in Islam. Eff149 65000kr 5 år kost 28730kr Tot93730kr. How can I get a loan from an Islamic bank.

In Islam you shouldnt have to. Emotionally you feel like youre engaged in haram and want to get out of it as soon as possible. Islamic financial institutions have struggled with the question of whether or not charging a monetary penalty for a late payment is considered a form of riba interest in Islam.

I have used this money to buy car which is in my personal use. Allaah has caused him to have no need of that because of the ways that He. Takaful is optional.

However I need to know if it would actually be haram for me to take bank loan for helping my friend who is in a pathetic condition if the monthly loan and everything ie. Paying interest is like receiving it forbidden.

Bank Islam Personal Loan Personal Loan Malaysia Pinjaman Peribadi

Bank Islam Personal Financing Gsparx

How Does An Islamic Personal Loan Work Comparehero

Dubai Islamic Bank Personal Loan Apply At Low Interest Rate

Tidak ada komentar:

Posting Komentar