Silk and Gold are Haram on Men. Literally interest means over and above a thing be it in money terms or in physical units of goods.

Dr Zakir Naik Is The Riba Which Is Prohibited In The Quran The Same As The Interest Of Modern Bank Dr Zakir Naik Facebook

Loan for investment eg for buying or expanding a business.

Is loan forbidden in islam. And Quran is the book of Allah Muslims god. Islam prohibits ribaa the paying and receiving of interest. In conclusion saying that Murabaha is permissible in Islam is nothing less than an insult to Muslims.

Loans are permitted in Islam if the interest that is paid is linked to the profit or loss obtained by the investment. Men wearing Silk and Gold. Any earnings from businesses involving haram or forbidden things are sinful.

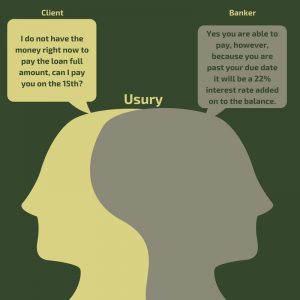

Haram is an Arabic term which means forbidden. In accordance with 3130 the Quranic definition of usury is a loan which interest rate exceeds 100 of the sum borrowed. The gratuitous nature of a loan is in line with the spirit of the Shariah which prohibits exploitation and injustice.

How an Islamic Loan works. Allaah has caused him to have no need of that because of the ways that He. The gratuitous nature of a loan is in line with the spirit of the Shariah which prohibits exploitation and injustice.

The true interest considered as haram forbidden is the amount a person has to return in multifolds of the principal taken. Usually it leads to a headache the discovery that a close friend is actually secretly a raging capitalistsocialist replace as per your political proclivities and the worrying one doubt about ones religion and moral code. The interest is known as riba and it is not allowed to a Muslim.

Aug 13 3 min read. It is spiritually damaging to one for as long as one is in that transaction. Whoever is unable to work and is poor is allowed to ask for help and to take zakaah and social security.

However this doesnt mean that you have to put the repayment of. It implies that Islam includes pointless commandments that carry no value to the adherent. One of the golden features of the Islamic banking business is the prohibition of interest in financial transactions.

The concept of profit acts as a symbol in Islam as equal sharing of profits losses and risks. Beloved brother the reason riba usury interest etc is considered haraam in Islam is because the All-Knowing All-Wise Lord Who Created has condemned it as haraam and absolutely forbidden it for the believers who sincerely believe in Him and the Last Day. They say that the riba forbidden in Islam only applies to loan for consumption and not to Loan for investment thus allowing charging of interest on a loan given for investment This was also brought to my attention by a friend who reviewed the manuscript of this treatise.

Finance in Islam is a serious subject a Muslim are not allows lending or borrowing money and benefiting from it any way it is not allowed in Islam. Hadith means the sayings of the Holy prophet PBUH of Muslims. Praise be to Allah.

That riba that the Quran prohibits is that kind of interest that exploits the borrower. Riba is the act of lending money with interest. Paying an interest rate over a predetermined period of time is exactly the same as paying a fixed sum.

Committing such a sin is so grave that it leads to hell 4161. Mentioned above loans are forbidden to pay any stipulated benefit the Qard mode is a popular Islamic. Haram means that avoiding things that are not allowed in hadith and Quran.

Because of this Islamic banks and Islamic finance institutions have come up with Islamic home lending products that follow shariah rules. I am against traditional loans for one reason. A mortgage is a haraam riba-based transaction that is based on a loan with interest in which the owner of the money takes as collateral the property for the purchase of which the borrower is taking out the loan until the debt has been paid off along with the interest riba.

Why is this forbidden in Islam. A common type of Islamic loan is the Murabaha transaction. Riba is a concept in Islam that refers broadly to the concept of growth increasing or exceeding which in turn forbids interest credited from loans or deposits.

Allah may He be exalted has forbidden riba and has issued a. In Islamic banking however interest means over and above the principal loaned out for a period. This thread provides an answer.

Shaykh Ibn Uthaymeen may Allah have mercy on. All the basic principles of any Islamic banking come from the. In Islam a loan is considered a gratuitous contract.

The two major loan models used for an Islamic loan are. Because these two things are attributed to women only and Islam prohibits Men to be like Women and Women to be like Men. This action is forbidden in Islam and Allah places His wrath on those who engaged in it.

Shariah texts encourage Muslims to provide a loan to a person who needs it without any expectation of compensation reference. Interest rate loans are not strictly forbidden in Islam. Why does Islam forbid interest Thats a question we have all asked or been asked at some point in our lives.

Before answering your question please note that in my revised understanding it is not correct to say that any incremental amount paid on loan is not allowed. But I am against Murabaha for two reasons. A general practice before banking systems were introduced was when needy people borrowed money from lenders and had to return in bulk generally 3 or 4 times the amount of the principal.

Muslims are prohibited to own use produce manufacturer import or export prohibited haram goods or goods that contain haram elements. The Muslim whether he is rich or poor is not allowed to take a loan from the bank at 5 or 15 or more or less because that is ribaa and is a major sin. Islam prohibits all agreements and contracts that involve elements of chance maysir.

In Islam a loan is considered a gratuitous contract. Islamic finance is a very old concept which as old as Islam itself. Riba Interest is never allowed in Islam because it is a system that makes poor the poorest and rich the richest.

We may refer to it as usury. Acts which are forbidden in Islam are not to be done no matter how good your. But more importantly Islamically the state of being in an interest-bearing loan transaction is one that should be avoided.

My Halal Student Debt How Muslims Navigate University Loans Metro News

What Constitutes Haram Interest In Islam Quora

Riba And The Permissible Loan An Islamic Perspective Quran For Kids

Riba And Islam Usury Is It Halal Or Haram Guidance College

Is Mortgage Allowed In Islam I Nouman Ali Khan I 2019 Youtube

Tidak ada komentar:

Posting Komentar