Aside from monthly salaries employers in Malaysia need to contribute to EPF SOCSO and EIS of their employees according to the regulations. EPF refers to a social security institution under the Ministry of Finance Malaysia which manages a compulsory savings and retirement planning scheme for legally employed workers in Malaysia.

Employer Contribution Of Epf Socso And Eis In Malaysia

Applying for the EPF in Malaysia is compulsory on the part of the employer ie.

Is epf compulsory in malaysia. Filling it on their website itself Calling their hotline at 03-8922 6000. The Employees Provident Fund EPF is a government pension scheme compulsory for Malaysians but also offered to many expats. EPF in Malaysia follows EPF Act 1991.

Melayu Malay 简体中文 Chinese Simplified Employee Provident Fund EPF KWSP in Malaysia. QUOTE cherroy Mar 26 2014 1142 AM EPF and Socso are compulsory by law that employer must pay for every employee they hired. It is not compulsory for non-Malaysian citizens and non-Malaysian permanent residents to contribute to the EPF but they may elect to do so.

B Monthly wages exceed RM 5000 Minimum 12 of the employees monthly wages. Act 2015 contribution has been made compulsory across the board. It is not compulsory for non-Malaysian citizens and non-permanent residents to contribute to the EPF but they may elect to do so.

This page is also available in. If you do face such a situation of your employer not contributing to your EPF fund you can always file a complaint by. The EPF is publicly managed and financed through contributions.

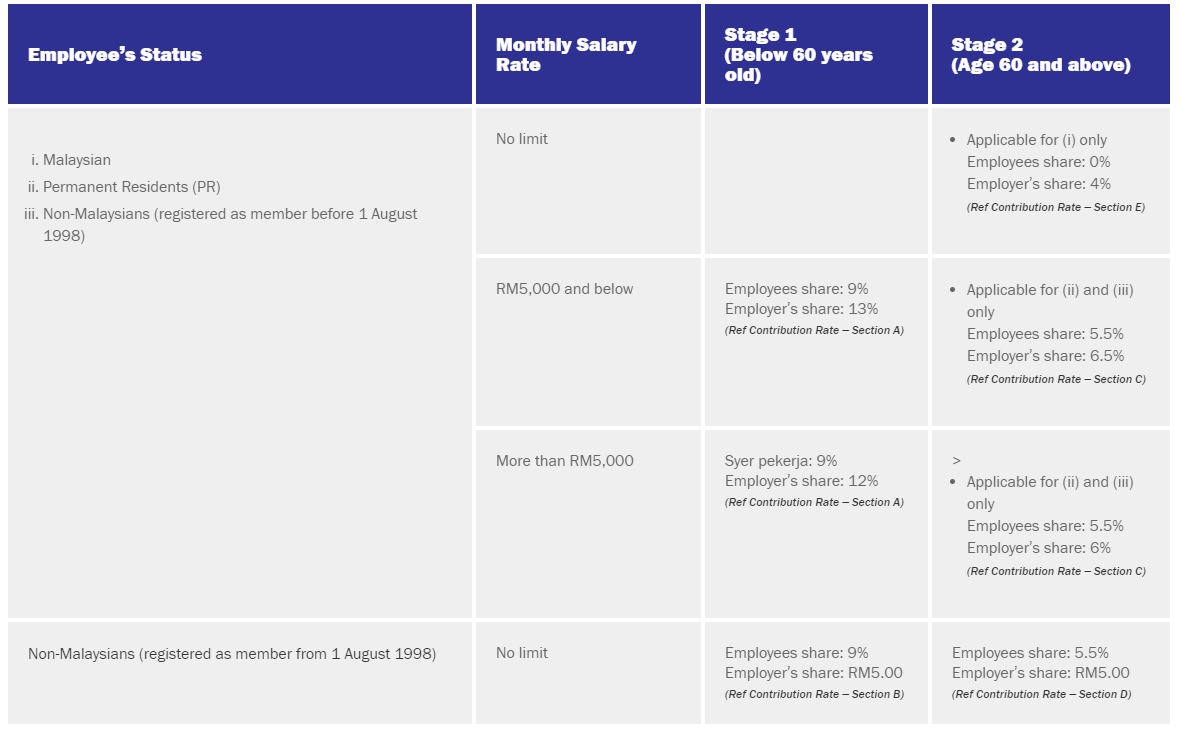

Employer contribution of EPF SOCSO and EIS in Malaysia. It is considered a vital component in Malaysias multi. 8 minutes Youve probably read our three-part series on EIS PERKESO and what it does for employees in the private sector in Malaysia here is the first part in case you haventWeve decided to write a few more to cover several of the more well-known institutions that youve definitely heard of starting with the Employees Provident Fund or EPF for short.

EPF requires contributions of at least 11 of each members monthly salary in 2012 and stores it in a savings account while the members employer must also contribute 12 13 for employees. The compulsory contributions under the Employees Provident Fund EPF Act 1991. The retirement scheme is fully funded and provides defined contribution type benefits to members.

EPF stands for Employee Provident Fund. A Monthly wages RM5000 and below Minimum of 13 of the employees monthly wages. All employees in Malaysia now has to contribute towards SOCSO.

The employer has to be the one who submits an application for each individual employee. Age Group 60 years and below. Mar 26 2014 1214 PM.

The Employee Provident Fund EPF the national compulsory saving scheme for individuals employed in the Malaysian private sector is based on the Employees Provident Fund Act 1991. It is to be noted that the fund is paid for and contributed by both the employer and employee and is calculated as such. Who are employed and whose country of domicile is outside Malaysia and who enter and stay in Malaysia temporarily under provisions of any written laws relating to immigration.

Employees Provident Fund Malaysia follows the same scheme to contribute for their retirement savings. The abbreviation EPF stands for Employees Provident Fund or in Malay it is commonly known as KWSP or Kumpulan Wang Simpanan Pekerja. As such weve prepared this complete guide on everything you need to know about EPF contributions in Malaysia.

Walking in to any one of their branches A list of their branches can be found HERE. This post has been edited by Azurika. Unless the employer 1st salary RM3K then no Socso or was it MR25k hmm.

An EPF is a government-managed retirement savings scheme that is compulsory in countries like India Hong Kong Singapore Malaysia Mexico and other countries that are similar to the United States. The EPF provides for compulsory retirement savings and contributions for all Malaysian citizens and permanent residents who are working in Malaysia. You may have noticed deductions from your monthly gross salary as stated on your payslip during your time as an employee before starting a company.

In many cases the EPF has accumulated into a substantial amount of money but it is important to remember that this is a vital element of your pension planning and. EPF Navigates Safely Through Pandemic-Stricken 2020. The Act opened up a platform that meets up legal ethical and moral obligations of Malaysian company employees.

The EPF provides for compulsory retirement savings and contributions for all Malaysian citizens and Malaysian permanent residents who are working in Malaysia. It is compulsory for Malaysian employees in the private sector and those holding non-pensionable posts in the public sector to make EPF contributions although non-Malaysian citizens can also choose to opt in. Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third ScheduleMonthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them.

Who needs to contribute to EPF. It is implemented on employers and employees of any private company running in Malaysia. SOCSOs chief executive Datuk Dr Mohammed Azman Aziz Mohammed said the amendment was made to ensure that all workers are protected under the scheme.

The great news is that EPF is paid out tax free upon leaving Malaysia. The Malaysian EPF is a compulsory pension scheme for all Malaysians. Form KWSP 16B submitted to the EPF with a copy to the employer.

The act that governs the Employees Provident Fund in Malaysia is the Employees Provident Fund Act 1991 and it is administered by the Employees Provident Fund Malaysia.

Malaysian Government Linked Investment Company Glic Adopts Icdl Assessment Solutions Icdl Asia

Employer Contribution Of Epf Socso And Eis In Malaysia

Tidak ada komentar:

Posting Komentar