If as is more typical you carry on your work or business elsewhere at an office perhaps but do some work at home occasionally you cannot claim occupancy expenses even if you have a home work area set. Printer paper and ink and stationery.

Working From Home Tax Deductions Covid 19

Partnership claim the deductions in your partnership tax return.

Is working from home tax deductible. These include expenses related to operating a home office including phone internet and designated home office furniture. Working from home to fulfil your employment duties and not just carrying out minimal tasks such as occasionally checking emails or taking calls Incurring additional deductible running expenses as a result of working from home. Here are 8 tax deductions you may be able to claim at tax time.

Phone and Internet expenses. If your employer gave you money for what you spent you cannot claim a deduction. That means youll have more things to claim on your tax return.

For a summary of this content in poster format see Home-based business expenses PDF 456KB This link will download a file. And more deductions means a. You can claim a deduction of 80 cents for each hour you work from home due to COVID-19 as long as you are.

With this method you can claim a deduction of 80 cents per hour you worked from home during the financial year between 1 July 2020 and 30 June 2021 if you were working from home to fulfil your employment duties ie. Working from home means hes also spent extra money on gas electricity phone and Wi-Fi internet. A deduction means you pay less tax.

If you spent your own money there is a new simple way to work out your deduction. Temporary shortcut method from 1 March 2020 to 30 June 2022 you may have the option of an all-inclusive 80 cents per work hour temporary shortcut method. Not just checking emails every now and then and you incurred additional running expenses as a result of working from home.

The Tax Cut and Jobs Act TCJA from 2017 includes some changes to this deduction making it more favorable for many self-employed individuals going forward. Company claim the deductions in your company tax return. You may be allowed to claim a deduction for working from home.

With many of us working from home during the coronavirus crisis there are several home office expenses you may be able to claim as tax deductions. There are recent changes to claiming your tax deductions. The good news is that yes if you are an employee now working from home due to the coronavirus outbreak you may be eligible to claim deductions for expenses that relate to that work.

Heres the good news. Tea coffee and milk are just a few of the items the ATO has flagged as. Employees who receive a paycheck or a W-2 exclusively from an employer are not eligible for the deduction even if they are currently working from home the IRS said in a September 2020 reminder.

You can only claim a deduction if you spent your own money. If youve worked 40 hours a week from home 48 weeks of the year full time thats going to be roughly a 1500 deduction under the 80. The Australian Tax Office ATO expects thousands of Australians to claim working-from-home deductions this financial year as coronavirus put the nation into lockdown.

So unless you want to start a side business thats based out of your home which may qualify you for the home office deduction then your best bet is probably to ask your employer. Under the shortcut method Ben can now claim a deduction at the rate of 80 cents per hour for the expenses he incurred as long as he has timesheet style evidence to prove how many hours hes worked. Just because your boss normally supplies tea doesnt mean its a tax deductible item when youre working from home.

In this article Ill discuss the qualifications and details of the Tax Cut and Jobs Act work from home deductions. If your home is indeed your place of work and you have an area set aside exclusively for work activities you may be able to claim both occupancy and running expenses. The home office deduction isnt available to employees after 2017 and the miscellaneous itemized deduction which covered unreimbursed work-from-home costs was eliminated.

Trust claim the deductions in your trust tax return. Sole trader claim the deductions in your individual tax return in the Business and professional items schedule using myTax or a registered tax agent. Work from home tax deductions could mean a bigger tax refund this year.

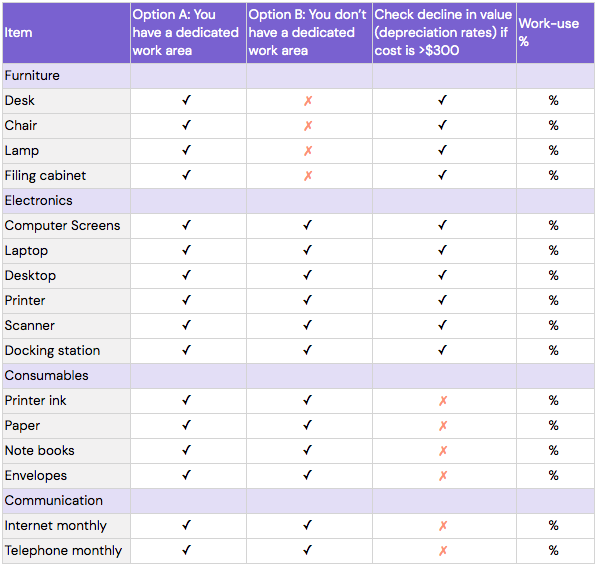

Working from home to fulfil your employment duties and not just carrying out minimal tasks such as occasionally checking emails or taking calls incurring additional deductible running expenses as a result of working from home. If work from home is your new normal then you probably use your own internet phone and power for work purposes plus in some cases your computer equipment and furniture.

6 Working From Home Deductions You Can Claim Box Advisory Services

Working From Home How To Claim Your Home Office Tax Deductions

Work From Home Tax Deduction Only Applies To Self Employed Workers

Working From Home Tax Deductions Covid 19

How To Claim Working From Home Deductions Kearney Group

Tidak ada komentar:

Posting Komentar