Student Loans and Islam Dr. Refer to the following as well.

Took Student Loan Didn T Know It Was Haram What Do I Do Now Assim Al Hakeem Youtube

Hajj Umrah On Credit Card Accepted Bank Loan In Islam Haram Business Riba Interest Ammaar Saeed.

Is student loan allowed in islam. These student loans incur interest on the repayments. Go to granny or grandpa and ask for a loan of a thousand if you have to. According to my friend some Imams say it is okay for educations sake.

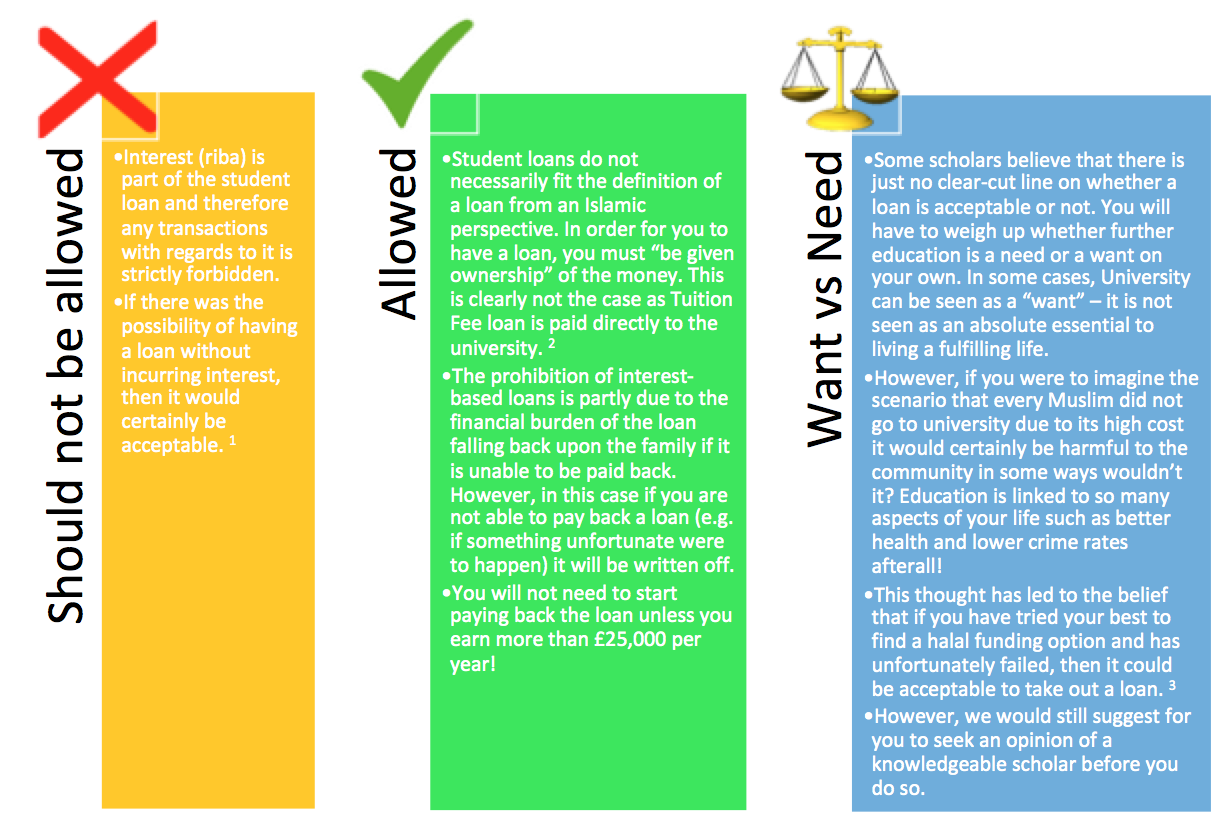

Like all other loans Student loans are also permissible as long as they dont involve interest. Student loans for undergraduates. There are currently 3 different opinions on the matter by.

Riba and School Fees. This leads them to the only available option which is Student Loans. Ive explained it here in detail.

Muzammil Siddiqi former president of the Islamic Society of North America ISNA says. Answer 1 of 21. Student Loan Allowed In Islam University Scholarship Fund Halal Haram College Funding Ammaar Saeed.

As the title says in Islam student loans are forbidden due to interest on it and as a Muslim I want to avoid it but I dont know how else am I meant Ask a question Log in. Yes these by Islamic definition are haram to attain IF there are halal options. RPI is a measure of inflation and the 3 is what they refer to as interest usually totalling 61 interest.

For Muslims taking out a loan and incurring interest on it is considered impermissible which makes university loans haram. My son is a student in the second year of university. 20 of that you will get back on taxes.

The student loans and tuition fees have interest on them therefore it is classed as riba and it is not allowed in Islam to take them. He took out a student loan but I did not know that this loan is haraam until recently. As long as your intentions are sincere Allah knows you have to educate yourself and earn a living and in this day and age paying and receiving interest is a way of life.

This is clearly not the case with the Tuition Fee loan as it is paid directly to the university. A loan is taken from a students loans company and repayments are made at RPI Retail Price Index plus 3 interest. For more information please see the answer to question no.

Cost is about 550-600 for six credits. From friends and family. I have just read this fatwa on Islam21C which seems sound.

For many Muslim students this is an issue many choose not to take out the loan as youre required to pay interest with the loan which is seen as forbidden in Islam. Based on that it is not permissible for you to take this loan because it involves a riba-based condition and you stated that you do not need that loan. The Islamic concept of finance considers money only a measure of value and a medium of exchange with no intrinsic utility.

Muslims across the UK have reacted differently to this issue but there are roughly three main camps in which students fall into. What is the current viewpoints on taking out a loan. In order for you to be given a loan you must be given ownership of the money.

The UK government offers eligible undergraduate students a Tuition Fee Loan and Maintenance Loan as part of the Student Finance funding system in the UK. Yes if one cannot get a ribā-free loan then its permissible halal to get a ribā-based loan for ones needs. Go to aunties and uncles and ask for a loan.

People including Muslims who want to go to college or university but cant afford it do not have the luxury of asking their parents loved ones or other family members for financial help. Student loans dont necessarily fit the definition of a loan from an Islamic perspective. You get these gems as you gain rep from other members for making good contributions and giving helpful advice.

So our view and that of a few scholars we have discussed this point with is that student loans are haram but if you have mitigated as much as you can and you really need to go to university and it will be genuinely worthwhile for you a student loan may be. Before 2012 this interest was set at the rate of inflation not at a commercial rate. But if you are taking 6 credits every other semester subsidized loans stay in student deferment meaning no interest accrues.

In order to pay off this loan my son has to get a job with an annual income of more than 21000 pounds otherwise he. Muslim students tend to take a student finance loan in order to go through university without financial strain but Ive recently discovered there is interest involved. Unfortunately for Muslims this policy change is not only an economic challenge it is also a moral one because as we all know Islam forbids dealing in interest and the student loan is unambiguously an interest-based loan.

Thus student loans as they stand are not suitable for Muslims. Allah does not want to punish you for an education loan or any loan as long as the parties are sincere and the purpose of loan is a necessity. It is important to note that whilst conventional finance treats money as a commodity that is able to earn profit in its own right.

Student loans in the UK are forbidden harām because it is a clear and apparent interest-based ribā transaction. Large loans from banks and businesses no matter if they are marked as an. The cost of these credits can be minimized by taking online classes at cheap state community colleges.

Report 6 years ago.

King S College London Halal Student Funding

My Halal Student Debt How Muslims Navigate University Loans Metro News

3 Reasons Why Student Loan Is 100 Haram Alternative Solution At The End Youtube

Alhamdulillah To The One Who Told Us To Stay Away From Riba Debt May Be Unavoidable But Good Reminder To Keep It As Low As Possible R Islam

Is Student Loans Allowed In Islam I Nouman Ali Khan I 2019 Youtube

Tidak ada komentar:

Posting Komentar