Is this kind of loan allowed in Islam. In Islam you shouldnt have to.

Is Student Loans Allowed In Islam I Nouman Ali Khan I 2019 Youtube

Camp A argues that while a conventional mortgage is usually haram taking out a conventional mortgage is a necessity today.

Is education loan allowed in islam. Every once in awhile someone in the student movement hears tell of interest in Islam being prohibited thinks about student loans for a microsecond and then comes up with the idea that student loans are unislamic and hence culturally inappropriate. Women and Education in Islam. Interest Islamic finance Personal finance.

What does Islam says about the student loan. The frenzy media most often show a poor village in a Muslim country where Muslim girls are not allowed to seek education. Saturday 15 April 2017.

And Allah knows best. For many Muslim students this is an issue many choose not to take out the loan as youre required to pay interest with the loan which is seen as forbidden in Islam. Dr Raheeq Ahmad Abbasi.

Then they connect it to Islam. Usually it leads to a headache the discovery that a close friend is actually secretly a raging capitalistsocialist replace as per your political proclivities and the worrying one doubt about ones religion and moral code. You have to return the actual amount of the loan neither less nor more.

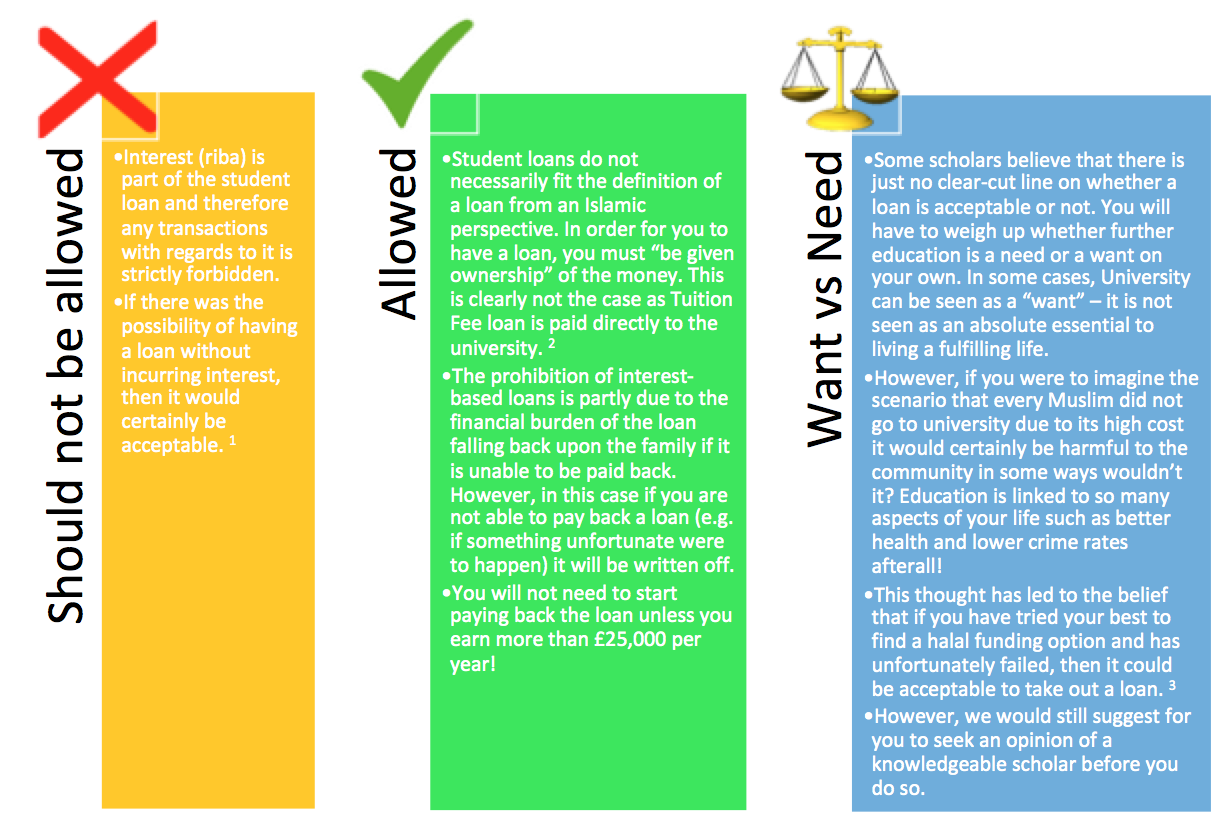

The second principle of Islamic finance is that one must work for profits and that money itself. The first wife of the Prophet Muhammad Khadeeja was a successful highly educated businesswoman in her own right. There are currently 3 different opinions on the matter by Islamic scholars.

So get yourself educated and you will be able to do more for Islam and humanity. Loan for investment eg for buying or expanding a business. Some of these Muslims argue that in fact conventional mortgages are halal.

Rather this action is recommended and affirmed. In opposition remission of a part of a debt not yet due involves Riba. Dar al-Ifta al Misriyyah is considered among the pioneering foundations for fatwa in the Islamic worldIt has been the premier institute to represent Islam and the international flagship for Islamic legal research.

This in the past has led some in Canada to claim that the whole student. Islamic banks around the world are reinventing the way we borrow. Whoever is unable to work and is poor is allowed to ask for help and to take zakaah and social security.

The answer is no. They aim to follow the Islamic rules. They are working in positions which involve usurious Riba transactions insurance the stock market and the like.

They use two arguments. When you borrow money you pay it back. The loan gets weaved off after 21 years if the student was unable to pay and will be discharged is the student dies without paying off the debt.

For Muslims taking out a loan and incurring interest on it is considered impermissible which makes university loans haram. Paying interest is like receiving it forbidden. Allah does not want to punish you for an education loan or any loan as long as the parties are sincere and the purpose of loan is a necessity.

In some cities of America and Europe the muslims are previledged to have access to sunday islamic schools where proper islamic education is being provided. Usually in many European countries students take up loans which they dont need to pay until they could earn up to certain threshold. Islamic Bank Home Loan works on 3 core principles that make it very different from normal loans.

They say that the riba forbidden in Islam only applies to loan for consumption and not to Loan for investment thus allowing charging of interest on a loan given for investment This was also brought to my attention by a friend who reviewed the manuscript of this treatise. Based on that it is not permissible for you to take this loan because it involves a riba-based condition and you stated that you do not need that loan. In fact rebate should neither be provided in the agreement nor be made a condition in the loan contract.

Duyoon Haalah are allowed by almost all Muslim jurists on the rationale that in such loans delay is not the right of the debtor. Remember businesses home ownership education etc are necessary to sometimes survive. After all The first revealed word of the Quran commanded the believers to Read And this commandment did not distinguish between male and female believers.

But as we all know many Muslims continue to use conventional mortgages despite the prohibition on interest in Islam. For more information please see the answer to question no. Non-conventional or Islamic banks grant interest-free loans called goodly loans or in simple language it is called qard-e-hasna.

AND Allah wants to help honest followers. The Muslim whether he is rich or poor is not allowed to take a loan from the bank at 5 or 15 or more or less because that is ribaa and is a major sin. They portray that Islam is to blame for this.

A bigger problem is being faced by parents in many countries in South Asia Africa where the islamic teaching to children has been left mosques and madrassahs where the imamsmaulvis teach islam with cultural socail and societal biasis. We are saddened to see Muslims today even those who practise many of the rules of Islam are working in jobs which involve haram in the financial sector. Gender inequality is a common accusation made against Islam and a disparity in educational opportunities between men and women in many Muslim countries is often cited as a primary example of this.

This requires you to refrain from taking this loan. An advice to Muslims working in the financial sector. There is a gross misunderstanding in the West that women in Islam are not allowed to seek education.

Except its not actually that simple. Most places you borrow from will charge you for loaning money from them. Why does Islam forbid interest Thats a question we have all asked or been asked at some point in our lives.

According to the teachings of Islam education is very important. The first one is that charging interest is not allowed instead of that the Islamic Bank in Australia must earn profit through some kind of services. He who takes a loan with interest does not take possession of it and it is not allowed for the borrower to utilize it.

However there is nothing that prevents paying the loan itself along with giving an addition without it being conditional. So if we take a goodly loan from a bank to buy the house then. Allaah has caused him to have no need of that because of the ways that He.

It fulfills its historic and civil role by keeping contemporary Muslim in touch with religious principles clarifying the right way removing doubts concerning religious and worldly. They give you an interest-free loan.

King S College London Halal Student Funding

3 Reasons Why Student Loan Is 100 Haram Alternative Solution At The End Youtube

Took Student Loan Didn T Know It Was Haram What Do I Do Now Assim Al Hakeem Youtube

My Halal Student Debt How Muslims Navigate University Loans Metro News

Education Loan Halal Shariah Council Of New York

Tidak ada komentar:

Posting Komentar