In addition to this the bank demands another amount if a. Why does Islam forbid interest Thats a question we have all asked or been asked at some point in our lives.

Riba And The Permissible Loan An Islamic Perspective Quran For Kids

Before answering your question please note that in my revised understanding it is not correct to say that any incremental amount paid on loan is not allowed.

Is loan permitted in islam. Ad Personal Loans up to 50000 Personalised Loan Rates from 535 pa. However this doesnt mean that you have to put the repayment of. This is the goodly loan.

Islam prohibits ribaa the paying and receiving of interest. Loans are permitted in Islam if the interest that is paid is linked to the profit or loss obtained by the investment. It is a sale in which it is permissible to stipulate an increase in price in exchange for deferring payment.

In this case the person is permitted to obtain a student loan as long as he has the sincere intention to pay back the loan on time without incurring interest. Usually it leads to a headache the discovery that a close friend is actually secretly a raging capitalistsocialist replace as per your political proclivities and the worrying one doubt about ones religion and moral code. There is no ifs and buts.

Loan for investment eg for buying or expanding a business. Now as you have asked the question that you have taken this home loan now your life has changed I would request you that you take a loan from an Islamic bank and repay this loan the home loan that youve taken repaid first and then slowly pay back to the Islamic bank should verify that the Islamic bank is on the guidelines of Sharia and it does not have Reba. No hidden fees or early repayment penalties.

It is spiritually damaging to one for as long as one is in that transaction. Ad Personal Loans up to 50000 Personalised Loan Rates from 535 pa. This form is prohibited in Islam because the bank is giving a loan to its customer to pay it back giving more than what he had originally taken.

In his response to your question Sheikh Ahmad Kutty a senior lecturer and Islamic scholar at the Islamic Institute of Toronto Ontario Canada states the following. How does Islamic finance work. Visit Ijarah Finance to know more.

They aim to follow the Islamic rules. Ad Citi Personal Loan Plus. The concept of profit acts as a symbol in Islam as equal sharing of profits losses and risks.

The movement started with. Allah says further in the Holy Quran Chapter 2 Surah Baqarah verse 278. Because of this Islamic banks and Islamic finance institutions have come up with Islamic home lending products that follow shariah rules.

A common type of Islamic loan is the Murabaha transaction. Dealing with riba interest is a major sin in Islam. Ad Citi Personal Loan Plus.

Borrow up to 75K with No Ongoing Fees. O Believers fear Allah and give up that riba which is still due to you if. Dear and beloved brother in Islam it is not the concept of car-financing itself but rather how exactly the financing is done which will determine whether the transaction is lawful or unlawful.

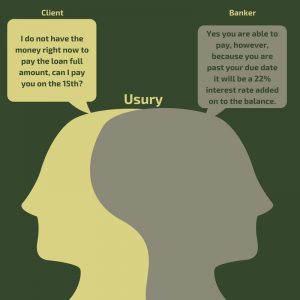

Charity Sadaqah has the reward of ten and the loan Qardh has the reward of eighteen. Australias finance sector is tapping into the Islamic market with one of the countrys biggest lenders launching a Sharia compliant loan and smaller instit. We may refer to it as usury.

Islamic Bank Home Loan works on 3 core principles that make it very different from normal loans. Borrow up to 75K with No Ongoing Fees. Non-conventional or Islamic banks grant interest-free loans called goodly loans or in simple language it is called qard-e-hasna.

In Quran and Sunnah you find stern warning against riba. Be it educational loan house loan or even marriage loan. The two major loan models used for an Islamic loan are.

Even though deferment is not considered real currency in murabaha there is an increase in price for deferment. They say that the riba forbidden in Islam only applies to loan for consumption and not to Loan for investment thus allowing charging of interest on a loan given for investment This was also brought to my attention by a friend who reviewed the manuscript of this treatise. Mortgage is permissible in Islamic law because it is a form of murabaha.

They give you an interest-free loan. You have to return the actual amount of the loan neither less nor more. No hidden fees or early repayment penalties.

Basically charging any kind of interest or earning from it is not allowed in Islam thus Islamic bank loans are a great way for Muslims to get loans for them. Apply for great rates through Harmoney. In another narration he said peace be upon him.

It is permissible to execute a verbal contract for a loan and as such by the action that a sum is given to someone with the intention of a loan and the other side takes it with this same intention. Allah says in Quran. Sharia-compliant banks have been experiencing a period of rapid growth especially in the non-Muslim-majority world.

Apply for great rates through Harmoney. Both situations are proper. That riba that the Quran prohibits is that kind of interest that exploits the borrower.

How an Islamic Loan works. While not every Muslim believes that charging interest is wrong it is part of Islamic or Sharia law and Islamic finance where no interest is charged is practised in a growing number of banks around the world. Those who consume interest cannot stand on the Day of Resurrection except as one stands who is being beaten by Satan into insanity.

No doubt this is pure Riba usury andor interest. But more importantly Islamically the state of being in an interest-bearing loan transaction is one that should be avoided. The kind of loan that is allowed in Islam is al-qard al-hasan a goodly loan in which you lend something to your brother so that he may benefit from the loan then he pays you back without any additional payment being stipulated and without paying less.

My Halal Student Debt How Muslims Navigate University Loans Metro News

The Don Ts Of Doing Business In Islam Inch Wide Mile Deep Fearthefire

What Constitutes Haram Interest In Islam Quora

Riba And Islam Usury Is It Halal Or Haram Guidance College

Tidak ada komentar:

Posting Komentar