If Yes then feel free to read further. So if you want urgent money due to lockdown then claim y.

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

Amid COVID-19 people are facing tough times due to mounting financial expenses.

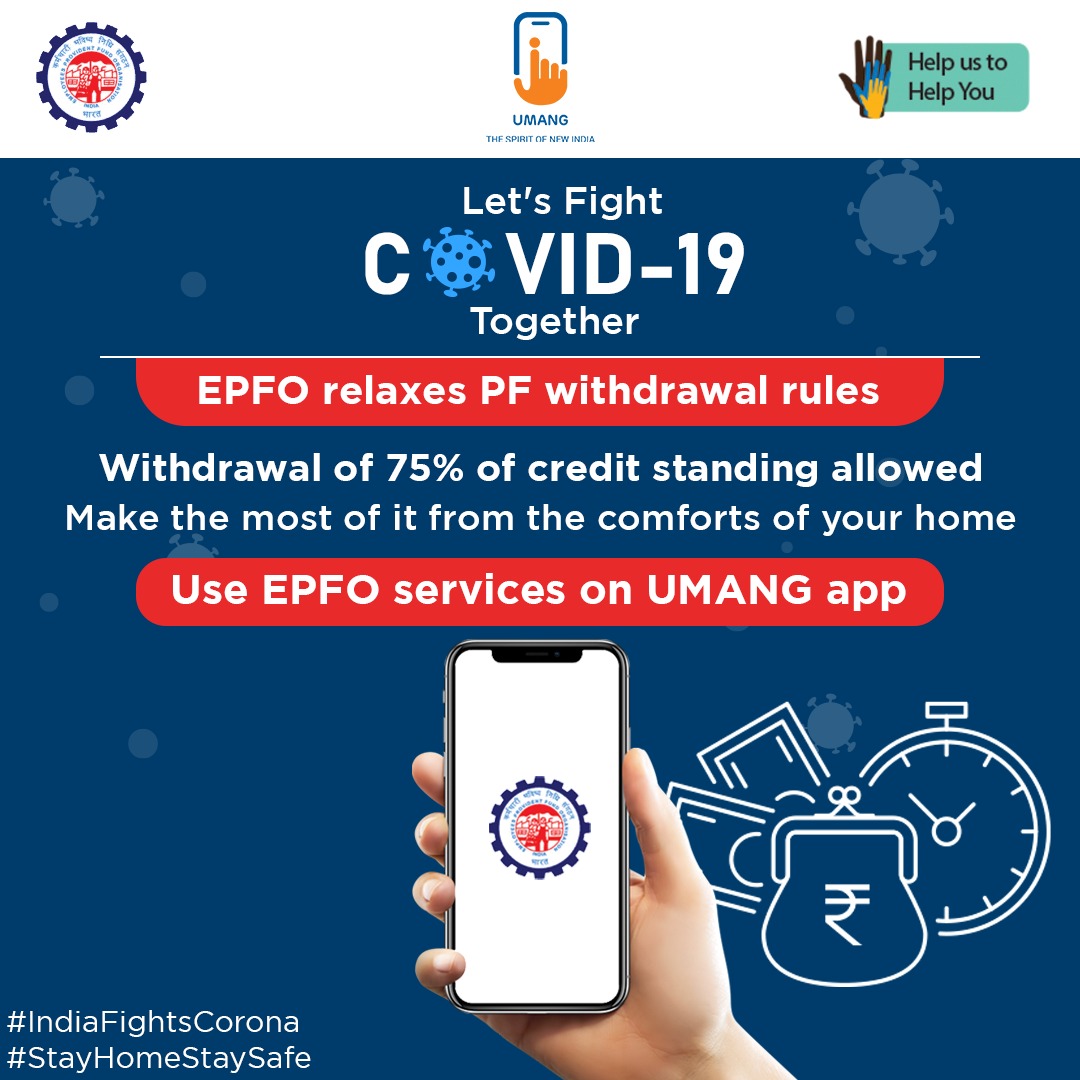

How to withdraw pf due to covid. Are you running out of cash amid Coornavirus crisis and want to withdraw from Provident Fund accountIt is. Last year the government allowed salaried individuals to withdraw from their Employees Provident Fund EPF if heshe is facing financial problems due to the coronavirus pandemicAn EPFO member can withdraw an amount equal to three months of basic salary and dearness allowance DA or 75 of the credit balance in the account whichever is lower for them. Due to COVID-19.

Heres how to withdraw advance from your PF account using THIS app. Such withdrawal is permissible for all the members of EPF. Here is a step-by-step guide to withdraw the amount.

You can get non-refundable withdrawal to the extent of the basic wages and dearness allowances for three months or up. The government has amended the EPF withdrawal rules to allow a EPF member to withdraw their money in case of emergency due to covid19 from their EPF account. According to the Ministry of Labour and Employment theres no lock-in period for all corona claims meaning that you can withdraw funds from your PF account even it was set up only a few months before.

If you are an EPF account holder and want to make. The government in March 2020 announced that an individual can withdraw a sum of money from EPF account during a final crisis caused due to covid-19. Therefore in this case the employee shall be eligible to withdraw funds from his EPF account up to Rs.

For example Mr Z an employee of a factory with an annual salary of Rs 72 lakh desires to obtain an advance from his EPF account as the factory is shut down due to the spread of COVID-19. The government has announced that an individual can withdraw a certain amount from. With lockdown in many parts of the country due to COVID-19 pandemic several people are facing economic hardships.

And this is getting worst with each passing day. Do you want to make an EPF withdrawal due to COVID-19 in order to satisfy your financial needs. The government announced back in March 2020 that an individual can withdraw a certain sum from their Employees Provident Fund account if heshe is facing financial problems due to the coronavirus-related lockdown.

To curb hassles the government last year announced that a person can withdraw a part of the amount from its Employees Provident Fund EPF account at. EPFO has allowed its members to avail the second COVID-19 advance from their PF account. The withdrawal will provide liquidity in the hands of employees during the COVID-19 lockdown.

The government has notified the amendment in EPF scheme rules regarding withdrawal of funds from the EPF account to deal with coronavirus-related financial. Subscribers were permitted to withdraw up to 75 per cent of the balance shown as credit in their EPF account or an amount up to three months of basic wages plus DA whichever lower. You can withdraw a part of the amount from your EPF account.

Funds withdrawn from the EPF for reasons other than covid before the completion of five years of continuous service attract tax. On May 31 2021 the EPFO made another announcement allowing subscribers to make a second non-refundable advance to accord top priority to COVID-19 claims. This means that the employee can withdraw a maximum of Rs.

The decision has been taken by the labour ministry due to the second wave of the Covid-19 pandemic. Authorities for the entire country and therefore employees working in establishments and factories across entire India who are members of the EPF Scheme are eligible for the benefits of non-refundable advance. In case of financial difficulties due to the Covid-19 the government last year announced that a.

EPF members were allowed to withdraw upto 75 of their provident fund balance if faced with financial stress due to Covid-19 pandemic. This is because COVID-19 has been declared a pandemic by govt. The ministry noted that the COVID-19 advance has been a great help to the EPF members during the pandemic especially for those having monthly wages lower than Rs 15000.

The COVID-19 advance has been a great help to the EPF members during the pandemic especially for those having monthly wages of less than Rs. Withdrawal from EPF due to Covid 19 was first declared in March 2020 as part of the Pradhan Mantri Garib Kalyan Yojana. Under the relaxation members are allowed to withdraw either 75 of their funds or three months of their basic salary plus.

There is now another provision where an amount which is either the persons 3 months basic salary and dearness allowance or 75 percent of the balance in their account. Under this relief measures relating to the Covid 19 pandemic. If the PF outstanding balance is withdrawn before five years of.

In this video session Ive explained how to make Advance claim for outbreak of pandemic COVID-19. EPFO allows its members to withdraw non-refundable withdrawal of up to three months of basic wages and dearness allowance or 75 of the amount available in the EPF account whichever is less. EPF Withdrawal for COVID-19 Online.

Covid 19 PF Withdrawal Time Period- Since COVID-19 has been declared a Pandemic by the Appropriate Government for the entire country and therefore the employees working in establishments and factories across entire India who are members of the EPF Scheme 1952 are eligible. 15000 the ministry added. The new PF advance or withdrawal rule will apply to all establishments across the country.

15 lakh and also place a withdrawal request for an amount lower than 15 lakh. Answer 1 of 2. However members can apply for lesser amounts as well.

COVID-19 In need of money for COVID crisis. Employees seeking an advance can make an online application using their login on the EPFOs website. It is important to note here that a request for EPF advance due to the COVID-19 situation.

Therefore the Government of India allows the salaried individuals to withdraw money from their EPF account.

How To Do Pf Withdrawal If You Need Money Due To Coronavirus

Mygovindia On Twitter Due To Covid 19 The Government Has Amended The Employees Provident Fund Withdrawal Rules Allowing Subscribers To Withdraw 75 Of The Credit Standing In Their Epf Account Or Three Months

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Epf Withdrawal Rules How To Withdraw From Epf If You Need Money Due To Coronavirus The Economic Times

Tidak ada komentar:

Posting Komentar